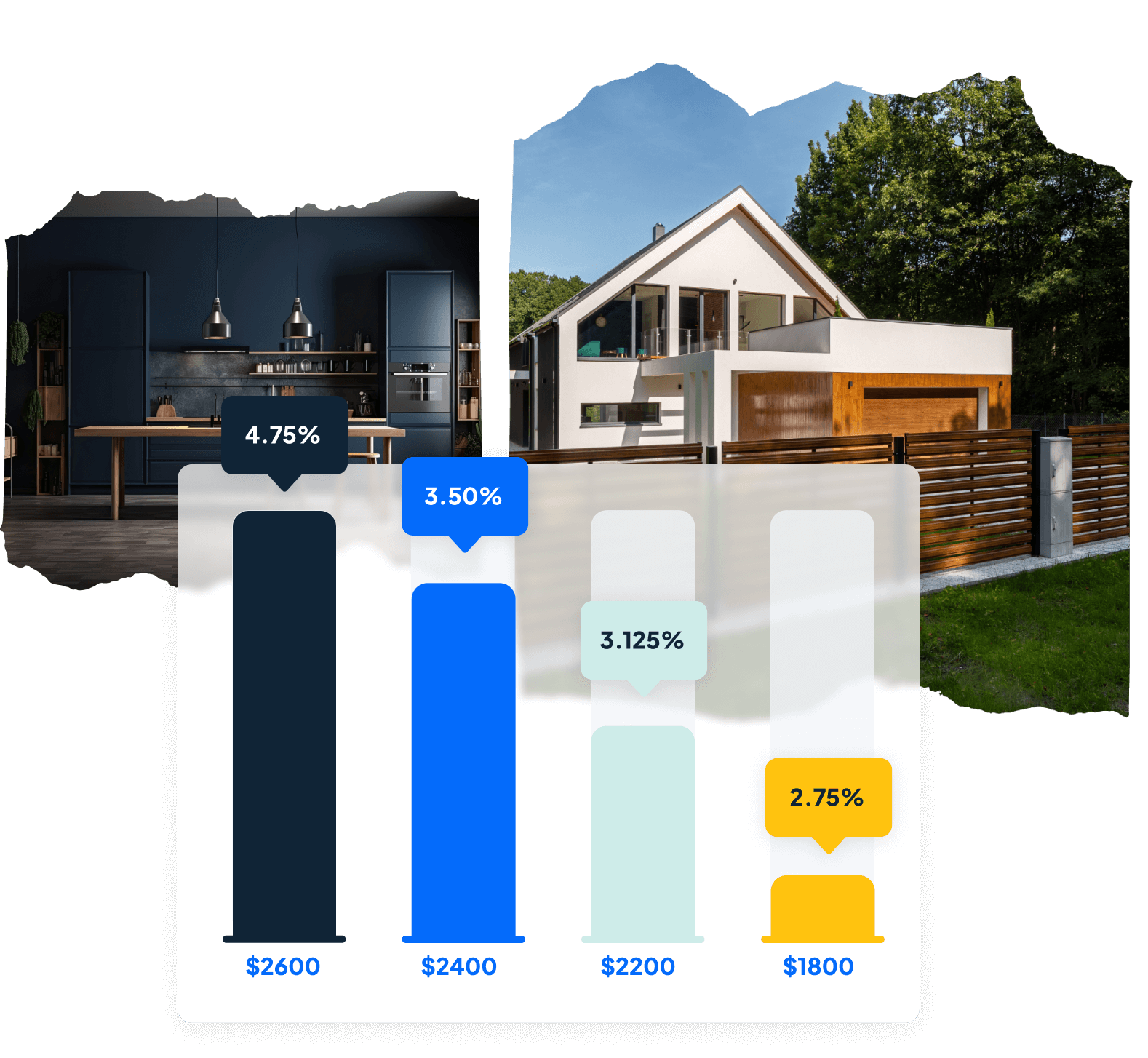

We help Homebuyers and Investors achieve the Right Mortgage

Lower rates, better lenders, flexible terms, we got them all!

Simple, quick, and stress-free, like moving home should be. We bring life, light, and hope to communities, and we are committed to taking you to the finish line. So get the loan you love!

Years In Business

Y/Y Growth

Customer Satisfaction

Years In Business

Y/Y Growth

Customer Satisfaction

Purchase Your Home

- You want lower rates

- We‘ve got them

Refinance your home.

- Lower your monthly payment

- Save thousands

Loan Options

Conventional loans are privately backed mortgages without government insurance. They follow Fannie Mae and Freddie Mac rules, known for being affordable and quick to close. Features:

- Purchase and refinance options

- 3% minimum down payment

- Debt-to-income ratio below 43%

- Minimum 620 credit score

FHA loans are insured by the Federal Housing Administration (FHA) and designed for low-to-moderate-income borrowers. They offer lower down payment requirements and credit score thresholds compared to conventional loans. Features:

- Purchase, refinance, and home renovation options

- 3.5% minimum down payment

- Minimum credit score of 580

- Ability to use gifts for down payments or closing costs

- Down Payment Assistance programs available

Procmyloan helps veterans achieve homeownership with VA home loans. These loans offer unique benefits like 100% financing, no down payment, no monthly mortgage insurance, and more. Features:

- 100% financing with no down payment

- No monthly mortgage insurance*

- Acceptance of gift funds for closing costs

- Reduced costs for disabled veterans

- Available to all, not limited to first-time buyers

- Competitive fixed interest rates

The USDA offers benefits for buying homes in rural areas. Their loan program allows for true zero-down financing, keeping your cash in the bank. Features:

- No down payment required

- 1% USDA required guarantee fee can be financed

- Seller contributions to closing costs

- Not limited to first-time homebuyers

Niche loans are for borrowers who don’t meet standard guidelines. They have higher risk, higher interest rates, and can’t be sold to government agencies. They can be commercial or residential non-conforming loans and are challenging to structure and sell to investors.

With a cash-out refinance, you receive a lump sum upon closing your refinance loan. The loan amount covers the payment of your existing mortgage(s), including closing costs and prepaid items like real estate taxes or homeowners’ insurance. Any remaining funds are then disbursed to you.

A rate and term refinance, also known as a rate and term option or ratio mortgage, enables you to modify the terms of your existing loan and replace them with more advantageous terms.

The Streamline Refinance program allows FHA-approved lenders to refinance existing FHA-insured loans to lower interest rates or different mortgage types. It involves reduced documentation and underwriting, saving time and costs. No cash can be taken out of this program.

A Jumbo loan exceeds the limits set by the FHFA. It’s a non-conforming loan for high-value properties, not eligible for Fannie Mae or Freddie Mac. Jumbo loans have unique requirements, including a high credit score, financial reserves, and a 20% down payment.

A reverse mortgage is a loan option available to homeowners aged 62 and older, particularly those who have paid off their mortgage. It enables them to borrow a portion of their home’s equity as tax-free income. In contrast to a traditional mortgage where the homeowner makes payments to the lender, with a reverse mortgage, the lender provides regular payments to the homeowner, hence the name.

Buy/Sell.

- Get Connected with a Realtor

- You've Got Options

Realtor Match

Realtor Match

Realtor Match

Realtor Match

Realtor Match

Realtor Match

About Our Company

We Are Fully Dedicated

To Support You

-Tanesha Tomlinson

Procmyloan Founder & CEO

JOIN US LIVE

PROCMYLOAN

FIRST TIME

HOMEBUYER CLASS

Learn how homebuyer education can change your decision towards homeownership.

JOIN OUR

COMMUNUTY

Learn from some of the top experts as they share their knowledge and insights about the industry. We share mortgage and real estate news and updates, as you interact in Q&A sessions designed to educate and empower you on your path to building wealth.

Taking the step towards homeownership can be challenging, which is why we have created this live medium designed to provide you with comprehensive education and guidance to help you make informed decisions throughout your homeownership journey.

Florida Down Payment National Grant Assistance -100% Forgivable!

How to Qualify for FREE Down Payment Money and Grants!

Experience Matters. We Can Help!

What are client saying ...

Marc

Eardly

Sasha

Hasan

Deon

Freda

Free Homebuyer Webinar Workshop

- Market Trends and Interest Rates

- Home Buying Process and Loan Programs

- Down Payment Assistance Programs

- Questions & Answers